At the end of October, the three-month motor finance repayment freeze, recommended by the Financial Conduct Authority (FCA) to help car buyers struggling with their finances during the pandemic, will be replaced by guidance that no longer includes this valuable break. Instead, from 1 November, the FCA expects finance companies to offer anyone facing repayment difficulties “a tailored package of support, taking into account the ongoing situation”.

The support the FCA recommends ranges from rescheduling payments or putting in place sustainable repayment arrangements to suspending or even cancelling interest payments. It’s generous, but should customers accept their lender’s help, the fact will be recorded on their credit file. While ensuring they only borrow responsibly, this could hamper a person’s ability to borrow money at reasonable interest rates and is a change from the guidance the FCA issued in April, which stated that lenders should ensure a borrower’s credit rating was unaffected by the help they received.

Combined with the end of the three-month repayment freeze for new applicants, it piles on the misery for people struggling with the economic consequences of the pandemic. Add the scaling back of the coronavirus job retention scheme and September’s rise in unemployment and redundancies and, for many people, now isn’t a great time to be paying for something as expensive as a car.

Already some are feeling the pain. Earlier this month, I visited my local Mazda dealer to have my car serviced. Without being prompted, a salesman told me he had experienced a rise in people coming to the showroom to discuss voluntarily terminating the finance agreement on their Mazda. Later the following week, a specialist in used electric cars told me the same story.

Often abbreviated to VT, voluntary termination allows borrowers to quit a PCP – and some other finance agreements regulated by the Consumer Credit Act 1979 – before it has run its course. To VT a car, a customer must pay or have 50% of the total amount payable under their finance agreement. Having done so, they can return the car to the finance company with nothing more to pay, save for any condition and mileage penalties due. VT shouldn’t be confused with early settlement, by the way, where the customer pays the total amount outstanding and then owns the car outright.

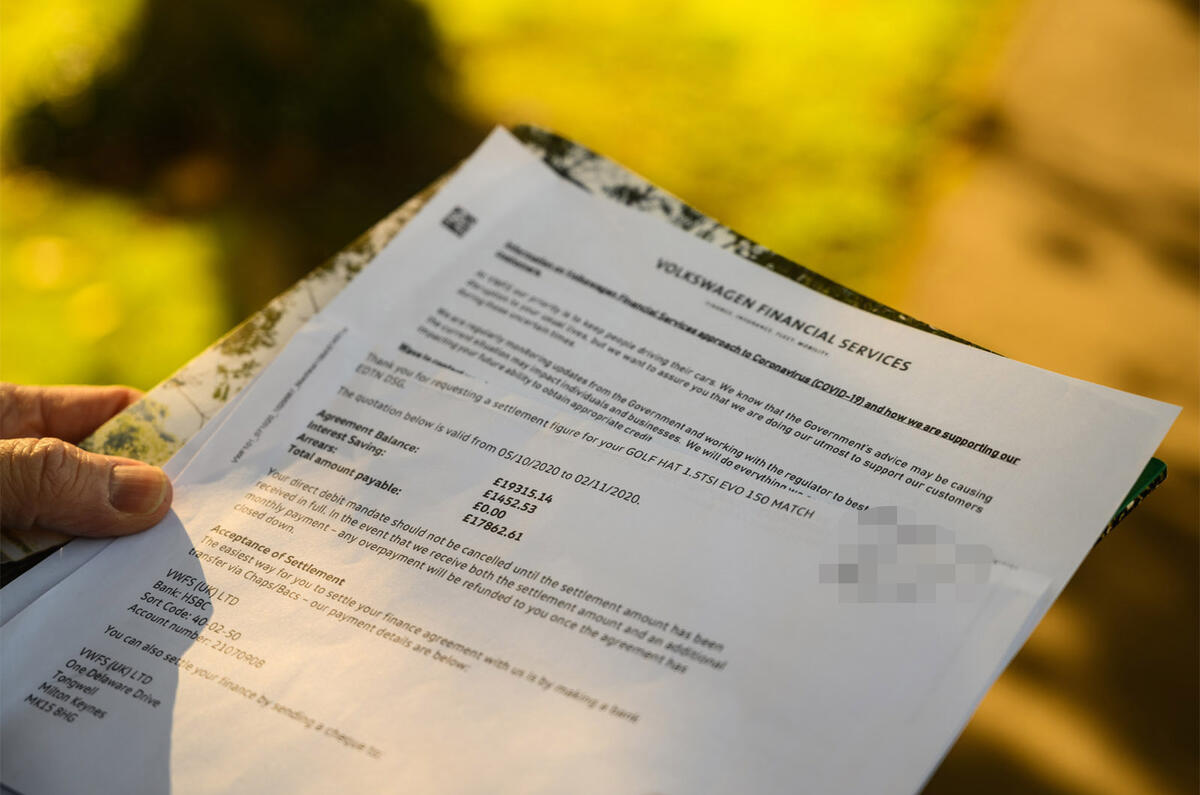

VT is a useful escape route but can be an expensive one. For example, my neighbour has a Volkswagen Golf 1.5 Match Edition Mk7 on a four-year PCP. She’s one year into the deal, but to VT it would cost her £6500 – the equivalent of a further 24 monthly repayments. It’s a lot of money, but it means that were she approaching the end of the agreement’s third year, she could VT the car with little or nothing to pay. Whenever it’s done, a VT is cheaper than taking the early settlement route (in my neighbour’s case, it would cost her £17,900).

Join the debate

Add your comment

Forget Finance!

Buy used with cash therefore no matter what happens in your life the car on the Driveway is yours. Forget what other people think.

Taxi!

This old chesnut has been used for a good number of years by higher end taxi drivers.....

VT isn't a secret. When my

VT isn't a secret. When my wife was changing the car every dealer we spoke to recommended doing a VT. Now I changing mine I'm getting the same message. PCPs are always under water until the end so its seen as a way of getting customers into cars every 3 years (on a PCP VT becomes viable around 3 years). BMW dealers in particular are keen to recommend it.

VT is why leasing is so much cheaper - the consumer protection around PCP is much stronger

Spoken like a true salesman.

So much cheaper than what?