Insurance premiums for electric cars will continue to rise unless the UK can find a cost-effective way of repairing damaged batteries rather than replacing them, warns Thatcham Research, an organisation owned by motor insurers.

This is because the component is worth up to 55% of the value of a new EV – and more as the vehicle ages and depreciates. As a result, some EVs that sustain damage to their battery in an accident are being written off.

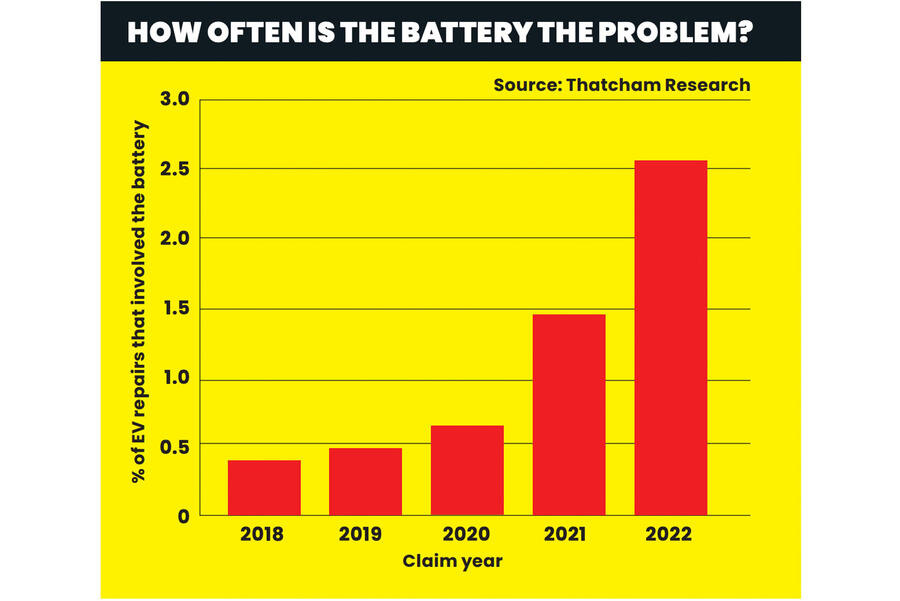

While the number of repairs is rising, it remains a very low proportion of total EV repairs, at 2%. Thatcham Research warns that as the number of EVs in the UK increases beyond today’s 1.5 million, it’s essential the UK develops a battery repair and refurbishment industry that will help to keep the costs of claims down.

Dan Harrowell, principal engineer of advanced technologies at Thatcham Research, said: “There’s a lot of discussion around recycling batteries, but as the insurance industry we’re focused instead on the repair, refurbishment and remanufacture of batteries.

“To maintain parity with ICE vehicles, we need battery refurbishment and repairs to be done by independent repairers, as happens in the replacement engine sector. The risk is that unless industry develops the skills to do this work, as we hit scale and as EVs age, writeoffs will be more considerable.”

Insurers are also concerned that replacing a damaged battery with a new one puts a policy holder in a better position than they were before their accident, because the car will be worth more with a new battery fitted.

“This falls into the debate the industry is having about ‘betterment’,” said Harrowell. “Refurbishment to a level equal to the original battery would solve a lot of our challenges.”

There are signs the industry is taking notice. In March, Cox Automotive and DHL combined to launch a centre for the repair and remanufacture of EV batteries for fleets. Located in Rugby, the 35,000sq ft facility has the capacity to process thousands of batteries a year.

Paul Stone, managing director of DHL Supply Chain UK, said: “This cooperation represents a major step forward in creating a scalable circular economy for batteries in the UK.”

Meanwhile, Grantham-based Autocraft Solutions, a remanufacturer of engines, is also repairing and refurbishing EV batteries. However, crucially for insurers concerned about betterment, it is restoring them to the condition they were in immediately prior to their failure.

Join the debate

Add your comment

For fans of cars and drifting, Drift Hunters is one of the best online racing games available. Players can choose from a wide variety of cars and customize them with upgrades, paint jobs, and new parts.